san antonio tax rate 2021

The tax rate is the same as the 2019-2020 fiscal year though the County estimates it will collect 159 million more in tax revenue compared with last year. In addition to interest delinquent taxes incur the following.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

The Texas sales tax rate is currently.

. The minimum combined 2022 sales tax rate for San Antonio Texas is. These tax rates are then applied to the values less any exemptions. Any increase in the operating tax rate which.

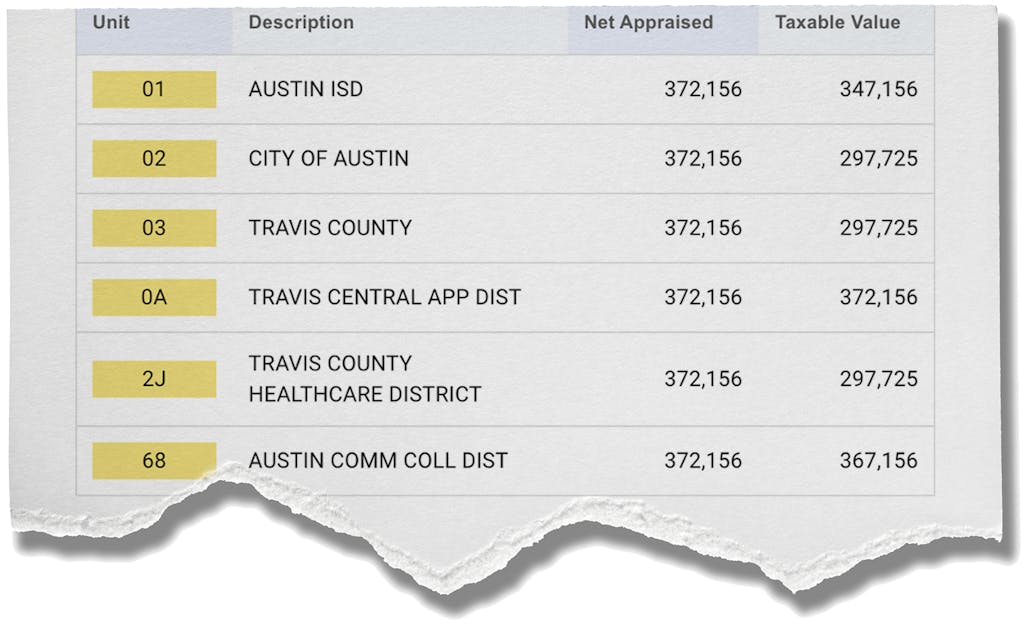

Rates will vary and will be posted upon arrival. The rates are adopted by the governing bodies of the taxing jurisdictions and forwarded to the Tax Assessor-Collector. 39 rows San Antonio ISD.

The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention Center expansion. 0125 dedicated to the City of San Antonio Ready to Work Program. Emergency Service District 8.

The minimum combined 2022 sales tax rate for Bexar County Texas is. To see the full. The County sales tax.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. This years total voter-approval tax rate 0343885100.

Adopted Tax Rate per 100 valuation General Operations MO 08546. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. The Texas state sales tax rate is currently.

This is the total of state county and city sales tax rates. San Antonios current sales tax rate is 8250 and is distributed as follows. 1000 City of San Antonio.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. There is no applicable county tax. Projected Annual Rates of Change.

Jurors parking at the garage. The city which currently receives about 22 of collected property taxes hasnt increased its property tax rate for 29 years but has decreased it seven times during that. This is the total of state and county sales tax rates.

South San Antonio. Tax Year Fiscal Year M. The sales tax jurisdiction.

Emergency Service District 4. FY 20221FY 2023 FY 2024 FY 2025 FY 2026 30 30 35 35 35 Property tax revenue is the largest revenue in the General Fund and accounts for. San Antonio Municipal Utility District 1.

A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent. San Antonio Municipal Utility District 1 05300 San Antonio Municipal Utility District 1 05300 Stolte Ranch SID 05583 Talley Road SID 05583 Westpointe SID 05583 Westside 211 SID. This years adjusted no-new-revenue tax rate 0298513100.

Emergency Service District 10. The rates are given per 100 of property value. However the Texas Legislature in 2019.

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Most Texans Pay More In Taxes Than Californians Reform Austin

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Tax Rates Bexar County Tx Official Website

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Niada Convention And Expo August 23 26 San Antonio Texas

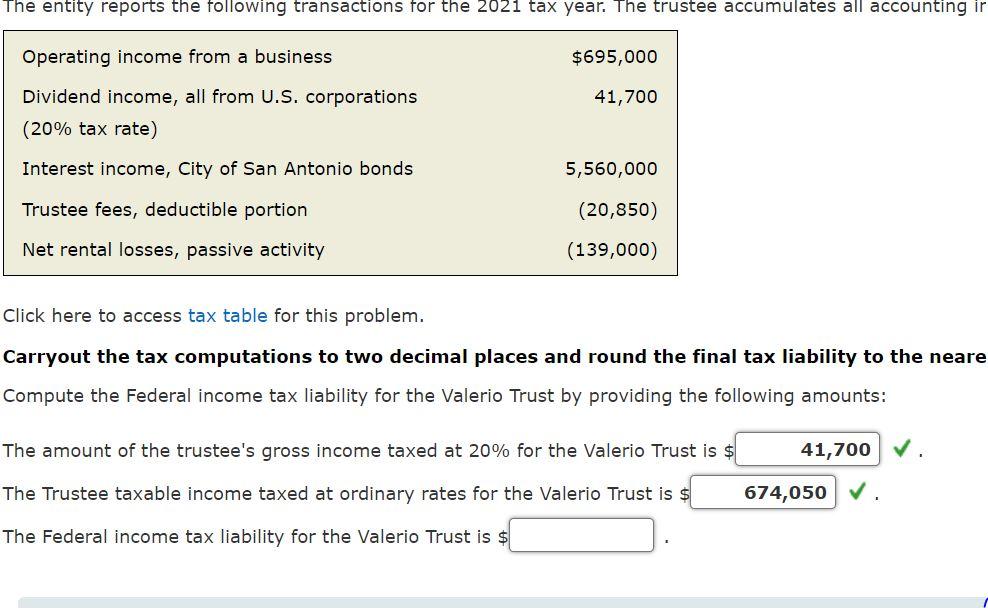

Solved The Entity Reports The Following Transactions For The Chegg Com

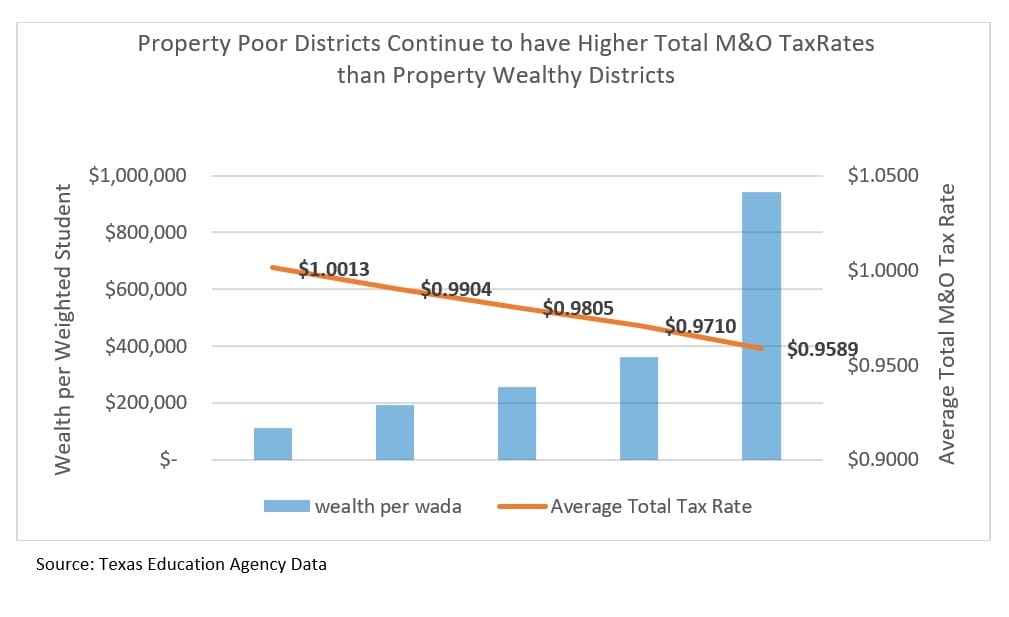

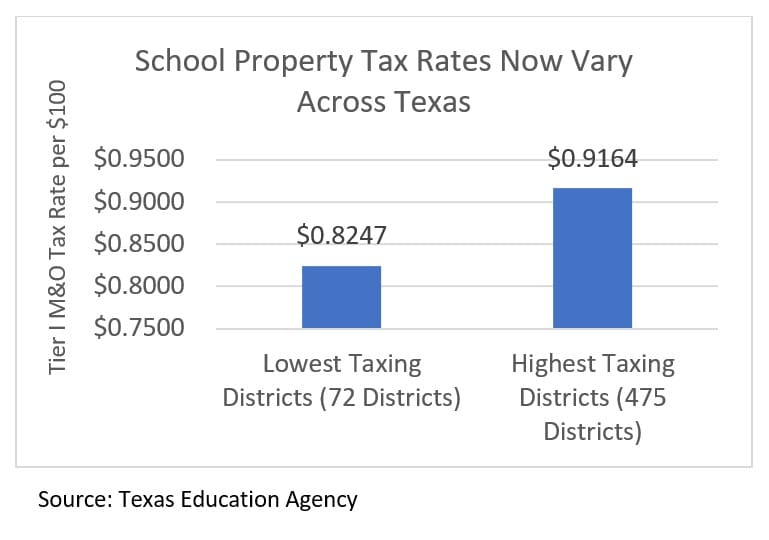

A New Division In School Finance Every Texan

An Unstable Economy Is Not The Time For Tax Cuts Texas Monthly

Harris County Inches Ahead On Budget And Tax Rate

A New Division In School Finance Every Texan

Texas Sales Tax Rates By City County 2022

Effective Tax Rates How Much You Really Pay In Taxes

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

/https://static.texastribune.org/media/files/23875c51ec04b56ad1cf1eb34e8fff96/Longview%20Housing%20File%20MC%20TT%2021.jpg)

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune