nj bait tax non resident

5675 for distributive proceeds below 250000. Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M.

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

For S-corporations BAIT is calculated.

. So on the federal side we have the 275000 of distributive proceeds. Pass-Through Business Alternative Income Tax Act. The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT.

Residents are allowed a refundable credit against their. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status you must file a New. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local.

NJ source income and non-NJ source income from the K-1. Similar to when estimated taxes are withheld on your paycheck. NJ Income Tax Nonresidents.

The original BAIT law allowed residents and non-residents who receive New Jersey-sourced income from pass-through entities to pay the business alternative income tax. Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a. NJ source income from the K-1.

Pass-Through Business Alternative Income Tax Act. 24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax. NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to.

The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the. Until 2022 there is a middle bracket of 912 for. The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT.

For New Jersey residents electing the BAIT can be an especially viable workaround to the SALT limitation. PL2019 c320 enacted the Pass-Through. The state of New Jersey requires either 897 percent of the profit or 2 percent of the total selling price whichever is higher to be.

Basking Ridge Nj Pest Control Services Viking Pest Control

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Florida A Tightwad S Paradise That Draws Residents From High Tax New Jersey Mulshine Nj Com

International Taxation Update Post Tcja Amp Covid 19 Amp Estate Ace Seminars

Take The Bait Why Nj Business Owners Should Reconsider The Business Alternative Income Tax Withum

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

State Of Nj Department Of The Treasury Division Of Taxation

Nj Business Alternative Income Tax Bait Law Change Sax Llp Advisory Audit And Accounting

What Ny Nj Ptet Changes For Taxpayers In 2022 Rosenberg Chesnov

New Jersey State Tax Updates Withum

Nj Salt Work Around Pass Through Entity Tax

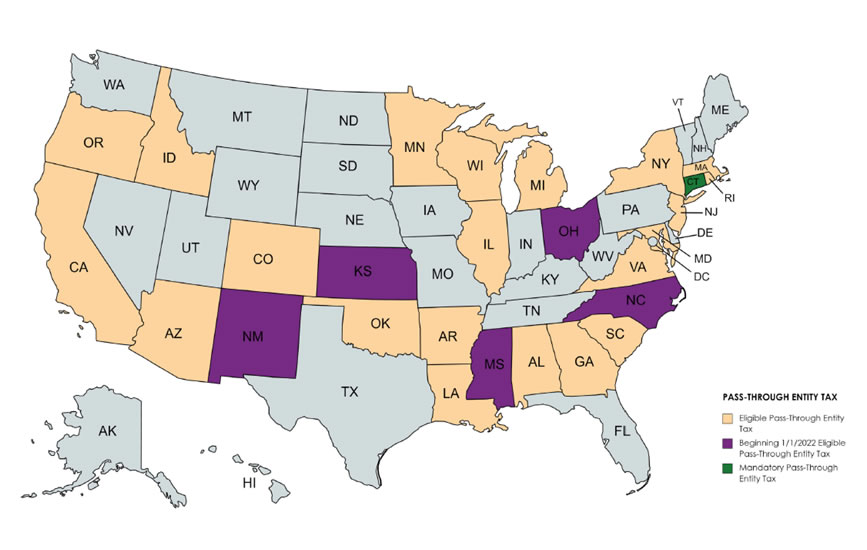

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

![]()

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine

Governor Murphy Signs Bait Clean Up Legislation

Multistate Pte Tax Update And Nj Bait E2201299

New Jersey Enacts Salt Deduction Cap Workaround Grant Thornton

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan