what is fsa health care 2020

HSAs are referred to as providing triple tax savings. What is the FSA amount for 2020.

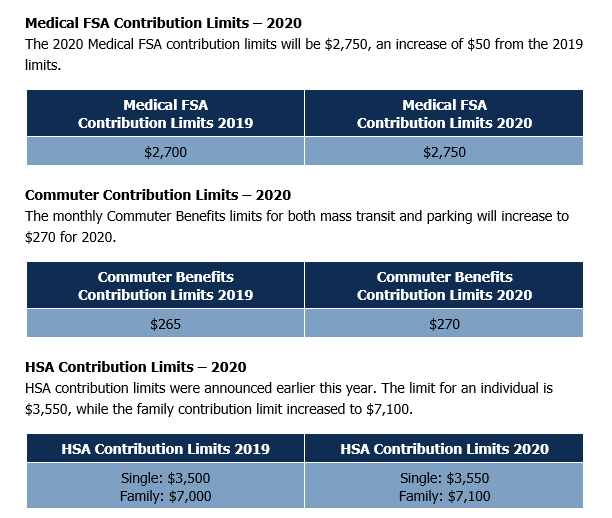

Irs Releases 2020 Contribution Limits For Flexible Spending Accounts Health Savings Accounts Retirement Plans Jorgensen Hr

For 2022 the maximum amount the IRS allows you to contribute to your healthcare FSA is 2850.

. The IRS raised contribution limits for. A FSA is a type of account that allows you to save money for various expenses. Pre-tax dollars are put aside from your paycheck into your FSA.

You will save money. Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and. You can choose to add any amount up to this limit.

Which costs are qualified for reimbursement is determined by the IRS. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Easy implementation and comprehensive employee education available 247. These are both ongoing and expected medical expenses. Tax-free interest or other earnings on the money in the account.

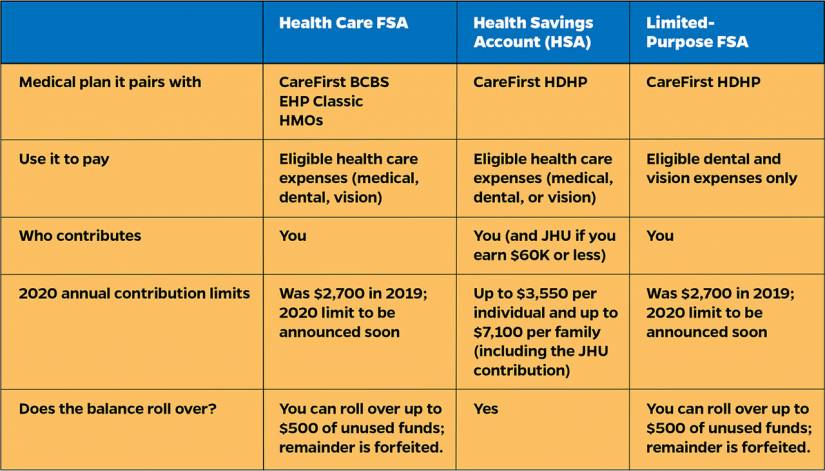

An Flexible Spending Account FSA is a valuable. Your FSA account funds reset. A limited purpose flexible spending account LPFSA pays for vision and dental expenses before you reach your deductible and sometimes for certain.

Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. But with open enrollment for the 2020. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses.

An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical. For that reason its important to check the limits each year before you determine your contributions. Your employer may also choose to.

This money is not taxed and is accessible as you need it. Its a popular option in many employer. Plan Year 2020 FSA Question and Answer Sheet This chart will give you basic information on the Health Care Flexible Spending Account HCFSA Program Dependent Care Assistance.

A full FSA is a benefits account to which you contribute pre-tax funds money deducted from your paycheck before payroll taxes are calculated. One of the biggest. Covers you your spouse and.

Health Care FSA vs. For one self-employed individuals arent eligible. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether.

You can use the funds for over-the. Your Health Care FSA covers hundreds of eligible health care services and products. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

An FSA is a type of savings account that provides tax advantages. Flexible Spending Accounts FSAs are for money you have set aside and earmarked for a particular use. Dependent Care FSA Health Care FSA.

Healthcare FSAs are a type of spending account offered by employers. 16 rows Your Health Care FSA covers hundreds of eligible health care services and products. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

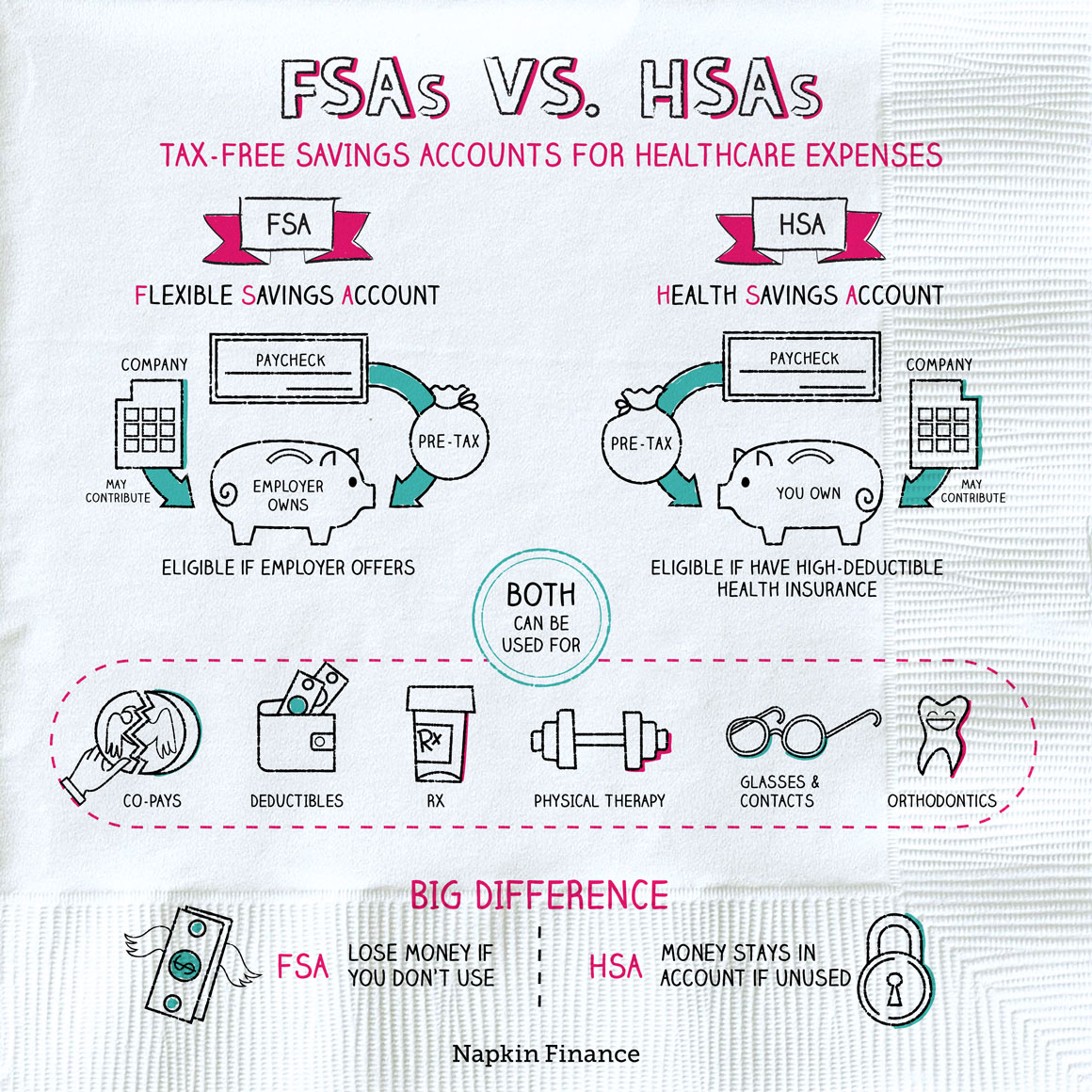

Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. FSA limits typically dont remain static.

You can use your Health Care FSA HC FSA funds to pay for a.

Your Track To Health Enroll In Your Health Fsa Between Oct 1 And Oct 31 2020

New Limited Purpose Flexible Spending Account For Saver Health Insurance Members Uk Human Resources

Cafeteria Plan And Fsa Relief Los Rios Community College District

How To Use Your Fsa For Skincare California Skin Institute

Impact On Hsa Fsa And Hra Benefit Accounts Oca

What To Know About Spending Accounts For 2020 Hub

Hsa Vs Health Care Fsa Which Is Better Group Health Insurance

Benefits Guidebook January 1 December 31 2020 By Wfu Talent Issuu

Flexible Spending Accounts Fsa The City Of Portland Oregon

Which One Is Better For Me An Fsa Or Hsa Bri Benefit Resource

What Is The Difference Between Fsa And Hsa Updated 2020 Stephen Zelcer

Amazon Is Now Accepting Fsa And Hsa Cards As Payment

Fsa Vs Hsa Use It Or Lose It Napkin Finance

2021 Benefits Enrollment Health Accounts Hsa Fsa Hra Intrepid Eagle Finance

Alan Robinson Dds Pc Dentist In Clinton Township Carry Over Your Fsa Funds

What S The Difference Between Hsa And Fsa Benefits Solutions Group